Your Best Choice of Personal Financing

Life is made up of many defining moments, and whether it is to prepare for your wedding, buying a new property or furthering your education, AmMoneyLine / AmMoneyLine Facility-i is your trusted companion in every journey. You can choose from either Cash-Out Plan to get extra cash in hand, or Debt Consolidation Plan to consolidate your debts into a single payment. Don’t wait, apply now to savour the great moments in life.

Cash-Out Plan

- Low interest / profit rate from 8.00% – 11.99% per annum

- NO guarantor / collateral required

- Payment period of between 12 – 60 months

- High Disbursement Amount – Maximum 10x of your gross monthly income or RM150,000, whichever is lower.

- Get Rewarded For Timely Repayments – Enjoy 5% cash rebate per annum on total interest / profit paid when you make payment on time

Debts Consolidation Plan

- Simplify your finances by consolidating your credit card and personal loan / financing accounts into ONE account

- Save up to 2% per annum on interest / profit

- Payment period of between 12 – 60 months

- Competitive rate for immediate interest / profit savings

| Items | Details |

|---|---|

| Minimum Age | 21-60 years old (upon maturity of facility) |

| Nationality |

|

| Minimum Income | Salaried Employees:

|

| Documents Required |

To expedite processing, please enclose photocopies of the following documents:

|

Note: Customers who opt in for Bank Negara Malaysia’s (BNM) loan / financing deferment initiative will not be eligible to receive 5% cash rebate per annum on total interest / profit paid. For more information, please refer to our FAQ here.

Your Best Choice of Personal Financing

Life is made up of many defining moments, and whether it is to prepare for your wedding, renovating your house or furthering your education, AmMoneyLine / AmMoneyLine Facility-i is your trusted companion in every journey. You can choose from either Cash-Out Plan to get extra cash in hand, or Debt Consolidation Plan to consolidate your debts into a single payment. Don’t wait, apply now to savour the great moments in life.

CASH OUT PLAN

Enjoy Affordable Interest/Profit Rates

With ranging from 8.00% - 11.99% per annum

Flexible payment period

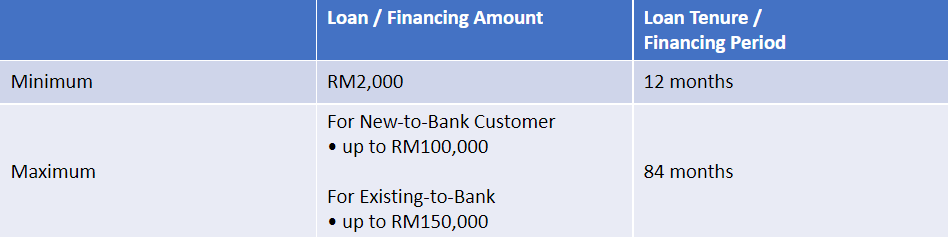

Of between 12 – 84 months

Up to RM150,000

High disbursement loan/financing amount of up to RM150,000

Quick & hassle-free process

With no guarantors / collaterals required

RM

Debt Consolidation Plan

All Your Finances At One Go

Simplify your finance by consolidating your credit cards and loans/financing accounts into ONE

Great Savings

With immediate savings on interest/profit.

Hassle-free Approval

Better approval as no double count of DSR with minimal document needed

Hassle-free Approval

Better approval as no double count of DSR with minimal document needed

Better Cash Flow

Better cash flow management from ONE account

Payment Period of Your Choice

Flexible loan/financing tenure of up to 84 months

Affordable Interest/Profit Rates

Competitive interest/profit rates for immediate savings

Minimum Age:

21-60 years old (upon maturity of facility)

Nationality:

Malaysian citizen; OR

Permanent Resident working in Malaysia

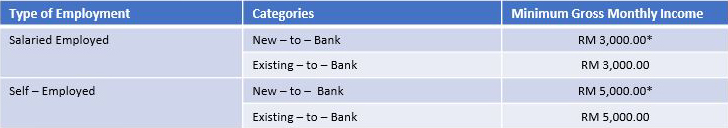

Salaried Employees:

RM36,000 for existing Bank customers

RM60,000 for new to Bank customers

Self Employed:

RM60,000 for existing Bank customers

RM120,000 for new to Bank customers

Application form

Photocopy of NRIC (Front and Back)

For Salaried Employee:

Fixed Salary Earner

i. Latest 1 month’s salary WITH Bank statement where salary is credited / Latest EPF statement / Latest BE Form with corresponding Tax Payment Receipt / Latest EA Form* / Notice of Assessment (NOA); OR

ii. Latest 3 consecutive months’ Salary Slip; OR

iii. Latest 3 months’ EPF/CPF statement

*Applicable for Group of Multinational Corporation (MNC), Government Linked Company (GLC), Public Listed Company (PLC) and Financial Institution (FI)

Other than above, corresponding income evidence (eg. Tax Return / E-Filing / Bank Statement, etc) must be provided.

Fixed Plus Variable

i. Latest 3 consecutive months’ Salary Slip WITH Bank Statement where Salary is credited / Latest EPF statement / Latest BE Form with corresponding Tax Payment Receipt / Latest EA Form* / Notice of Assessment (NOA); OR

ii. Latest 3 months’ EPF/CPF statement

*Applicable for Group of Multinational Corporation (MNC), Government Linked Company (GLC), Public Listed Company (PLC) and Financial Institution (FI)

Other than above, corresponding income evidence (eg. Tax Return / E-Filing / Bank Statement, etc) must be provided.

Full Commissions Earner:

i. Latest 6 consecutive months’ Commission Statement / Statement of Account (SOA); OR

ii. Latest 6 consecutive months’ Bank Statement; OR

iii. Annual Statement or Commission Earned; OR

iv. Latest BE Form with corresponding Tax Payment Receipt

For Self Employed:

Sole Proprietor

i. Form A & D (Business Registration) / Trading License for East Malaysia / Unregistered Business); AND

ii. Latest 6 consecutive months’ Personal or Business Bank Statement; OR

iii. Latest year BE/B Form with corresponding Tax Payment Receipt & 1 month Personal or Business Bank Statement; OR

iv. E-Filing acknowledgement receipt & Latest 1 month Personal or Business Bank Statement; OR

v. Latest 6 consecutive months’ Statement of Accounts (SOA) from relevant authorities / MNC / PLC / FI

Partner

i. Form B & D (Business Registration for West Malaysia) / Trading License for East Malaysia; AND

ii. Latest 6 consecutive months’ Business Bank Statement; OR

iii.Latest year B Form with corresponding Tax Payment Receipt & Latest 1 month Business Bank Statement; OR

iv. E-Filing acknowledgement receipt & Latest 1 month Business Bank Statement

Director / Shareholder

i. Return of Allotment of Shares (formerly known as Form 24) ; AND

ii. Notification of Change in the Register of Directors, Managers and Secretaries Form (formerly known as Form 49); AND

iii. Latest 6 consecutive months’ Personal or Business Bank Statement

iv. Latest year BE Form with corresponding Tax Payment Receipt & Latest 1 month Personal or Business Bank Statement; OR

v. E-Filing acknowledgement receipt & Latest 1 month Personal or Business Bank Statement

Company:

i. Form 9 – certificate of incorporation of private company

ii. Form 24 – return of allotment of shares

iii. Form 49 – notification of change in the registration of director, manager and secretary

iv. Constitution of a written confirmation duly signed by director(s) confirming that the company does not have Constitute (formerly known as Memorandum & Articles of Association)

v. Notification of change in registered address (formerly known as Form 44, if applicable)

vi. Latest 6 consecutive months’ company bank statements & summary of bank statement analysis; OR

vii. Latest BE & B Form with tax payment receipt + latest 1-month company bank statement;

viii. E-Filing acknowledgment receipt + latest 1-month company bank statement

For selected Ambank/Ambank Islamic Payroll customers:

No income document is required.

Frequently Asked Questions

• AmMoneyLine/ AmMoneyLine Facility-i is an unsecured Personal Loan/Financing which requires NO collaterals or guarantors.

• This product has a fixed monthly payment schedule and is available under both conventional and Islamic banking.

• Customers can select from two programs below:

(i) Cash Out Program

(ii) Debts Consolidation Program

• Malaysian

• Age 21 to 60 (at maturity). E.g.: If the applicant is 56 years old, he/she can only apply for a loan/financing tenure of not more than 4 years.

* Terms and Conditions apply.

0.5% of total loan/financing approved amount for both conventional and Islamic product.

Interest / profit rate is based on Employment Type and Financing Amount. It ranges from 8.00% to 11.99% flat per annum. (EIR/EPR: 14.13% to 21.55%).

* All application are subjected to credit assessment and approval

Yes. Customer will be notified via SMS if the application is approved. If the approved amount is not within the acceptance range, customer will receive calls from the Bank to inform on approved amount. The Bank will send below letters for approved application:

-Letter of Disbursement (Upon loan disbursement)

-Letterof Commencement

• For Cash Out Program, funds will be deposited to customer’s individual AmBank/AmBank Islamic Current or Savings Account/-i.

• For Debts Consolidation Program, funds will be directly payoff to required credit cards or loan/financing account.

• Disbursement is strictly to active and first party account only.

• Disbursement to offset AmBank/AmBank Islamic loan/financing account is not allowed.

Loan/Financing will be approved and disbursed within 72 hours provided full documentation is submitted during application.

1% per annum on monthly instalment or any amount due but remain unpaid.

No early settlement fee/charge but customers are required to give 1 month written notice in advance for early settlement.

All installments are deemed as fixed and no changes are allowed.

• Yearly statement will be issued in December and delivered via normal mail or email.

• Yearly statement can also be viewed and downloaded from AmOnline.

• By direct debit standing instruction from AmBank/AmBank Islamic Current or Savings account/-i.

• By using online banking or GIRO fund transfer.

• By cash at any AmBank/AmBank Islamic branches nationwide.

• By cash through AmBank Cash Deposit Machine (CDM) or Automated Teller Machine (ATM).

• By Monthly Payment Authorisation (Auto-Debit) from AmBank / AmBank Islamic Current/-i or Savings account /-i

Yes. Customer need to sign up the standing instruction with the bank that he/she wishes to appoint.

- The period of payment of the facility and interest/profit rate thereon as stated in the Notification Letter